By Rev. Booker T. Lewis II, Rev. Chris Breedlove, Dr. Don Simmons and Andy Levine

A casual drive through Fresno can quickly turn into a case study in poor city planning. If you’re driving through the city’s northern neighborhoods, you’ll see grocery stores, movie theaters, banks and parks. Cross Shaw Avenue heading south and you’re suddenly bombarded with liquor stores, bail bondsmen, vacant homes and payday lenders. This didn’t happen by accident. For decades, developers—with the full complicity of the City Council—have abandoned older neighborhoods and fled north to cash in by offering the “next big thing.”

What happens when entire neighborhoods are left behind by traditional industries? Well, in that drive through Fresno, you’re looking at it. In slow motion, you can almost see it play out: 1) urban sprawl has led to concentrated poverty (22 specific “pockets,” according to a Brookings Institution study that named Fresno as having the highest concentrated poverty in the nation), and 2) that poverty—exacerbated by the absence of banks, grocery stores and other conveniences—has been rich soil for an influx of outside corporations employing predatory business models designed explicitly to profit off of pain, vulnerability, desperation and depression.

It is under that backdrop that Faith in Community clergy and lay leaders recently decided to stand up and fight back against the perhaps most glaring (though certainly not only) example of this “concentrated usury”: payday lenders.

On the surface, payday lenders offer a pretty straightforward “product.” If you have a bank account and a source of income but are in need of cash before your next paycheck, they offer an “advance” on that check, up to $300. In exchange for that advance, they automatically take out 15% off the top, meaning a loan of $300 leaves you with $255 in your pocket.

While some would argue that’s already steep, unfortunately, it’s only the beginning. And we believe the whole model is based on the assumption that it’s only the beginning.

Under the agreement, the customer is expected to repay the loan by the next pay period. Well, guess what? Life happens. A medical emergency here, a grocery trip there and suddenly you’re unable to repay the loan a week or two later. Numerous studies have shown this to be the case for the overwhelming majority of customers.

And what does that mean? Well, in order to pay off the first loan, customers are forced to take out another loan—again at the 15% rate. This is where the debt spiral officially takes off. From that point on, according to studies, the average customer finds himself in debt to the lender for at least half a year and, when all is said and done, their long-term interest rate has skyrocketed to an APR (annual percentage rate) of well above 400%.

Our faith-based coalition has chosen a campaign name that reflects our intentions: Fresno CALLS: Campaign Against Legalized Loan Sharking. Let us explain what we are trying to do about this usury in our own backyard and how you can help. Unfortunately, that 400%+ APR is something that only Sacramento can address.

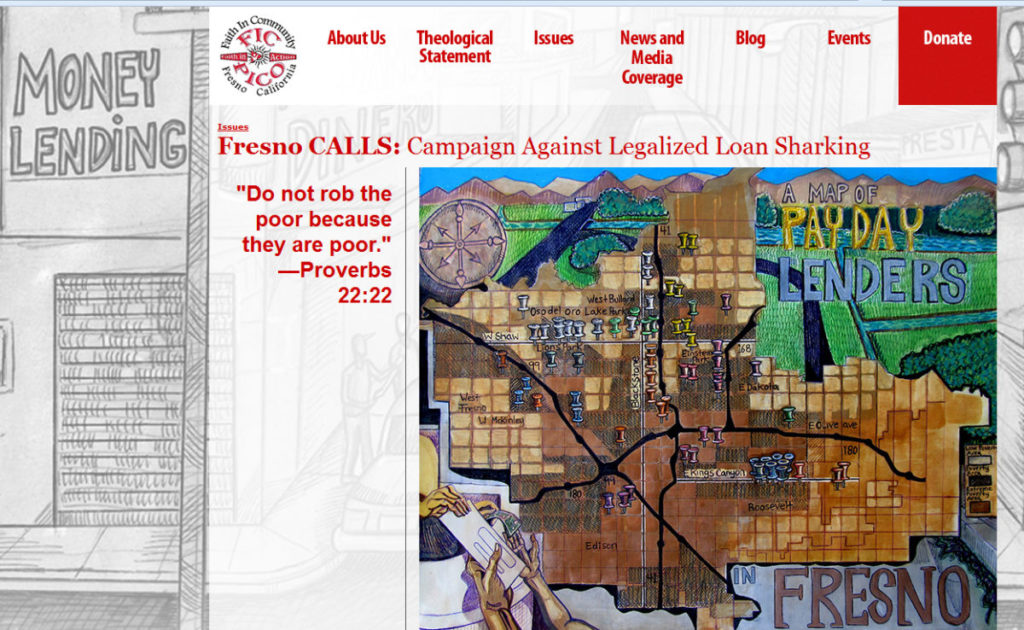

The good news, though, is that cities have significant land-use and zoning powers at their disposal, a jurisdiction that’s particularly significant in this case. By our count, there are at least 66 payday lender stores in the city of Fresno. (All but a handful of those are corporate conglomerates with catchy names like Advance America and Payday NOW.) Not surprisingly, most are in neighborhoods comprised of the working poor. Only 11 are north of Shaw Avenue. In southeast Fresno, there are eight alone on Kings Canyon Road between Chestnut and Willow avenues—a stretch less than a half-mile long. A few are literally next door to each other. Several are next to or even housed in liquor stores.

That is why we are pushing for City Council action to utilize its land-use powers and say “enough is enough.” We can’t legally do anything about the 66 stores already flooding our city. But we can stop this expansion, either through a moratorium, an outright cap, or a limit to where future stores can and cannot open.

As we hope the City Council will consider this in the next few weeks, we would like to present the City Council members with a list of thousands of local supporters. We hope you will take a moment to sign on in support at http://faithinfresno.org/fic/concentrated-usury.

*****

This article was co-authored by clergy members of Faith in Community (FIC). The FIC is a coalition of faith institutions working toward a more just, compassionate, equitable and thriving city of Fresno. The FIC is part of the PICO National Network, which is in approximately 150 cities across the country. For more information, visit www.faithinfresno.org or www.facebook.com/faithincommunity.