California hosts one of the greatest rivalries in sports: the L.A. Dodgers and the San Francisco Giants. This year, the rivalry reached a climax with the teams holding the best regular-season records and duking it out in the playoffs. However, fans of both teams—even if bitterly divided on baseball—can agree on something that affects all Americans.

Both sides can agree there is a moral responsibility to address a problem captured in this headline: “California’s homeless students could fill Dodger Stadium 5 times, study says.” Researchers at UCLA calculated that at the end of the 2018–19 school year more than 270,000 California students experienced homelessness—holding back their academic and career pursuits and our state’s economy.

This is just one of many maladies from a housing crisis that afflicts our country. Almost a quarter of renters pay more than half their income on rent. Millions of young children are exposed to lead paint, putting them at risk of permanent neurological damage. The Black-White homeownership gap is wider today than when housing discrimination was legal.

The financial services industry should be alarmed by these problems because of how they hold back economic growth. Also, addressing these problems is integral to advancing the racial and economic justice goals that many financial businesses have espoused.

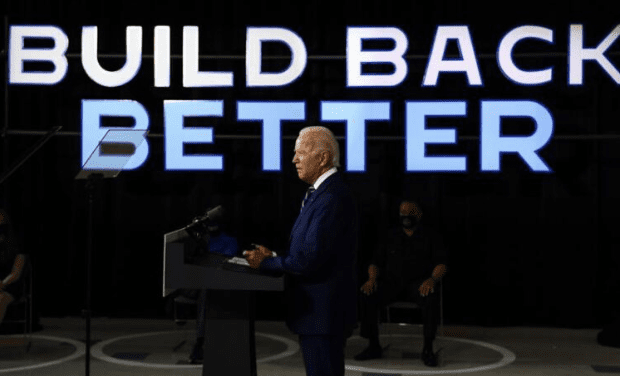

Our nation’s housing ills have policy prescriptions that are part of the Build Back Better Act, federal legislation that is a top priority of President Biden. While housing investments in the bill might no longer face total elimination, their funding has been pared down and the threat of additional cuts remains. It is critical for Congress to preserve these remaining funds and to pass the bill.

The good news is that leading members of Congress are advocating for housing. This includes House Speaker Nancy Pelosi and Senator Dianne Feinstein, who happen to be San Francisco Giants fans, as well as Senator Alex Padilla and the indefatigable House Financial Services Committee Chair Maxine Waters, who happen to be fans of the Dodgers.

These housing investments are worth going to bat for. A look at a few of them shows why.

For decades, funding from Congress has fallen far short of meeting people’s housing needs.

Currently, three-quarters of eligible households don’t receive any federal rental assistance because of underfunding. The Build Back Better Act would extend rental assistance to hundreds of thousands of additional households. These funds connect people with stable housing, offering manifold benefits. The assistance would provide relief for heavily rent-burdened families so that they can afford food, medicine and other essentials in addition to basic shelter. The funds would reduce overcrowding, which exacerbated the spread of Covid, and significantly reduce homelessness.

Also, far too many low-income families live in dilapidated apartments with leaking roofs, pest infestations, mold, lead, asbestos and other hazards that put them at greater risk of health problems such as asthma and cancer. The bill would make long-neglected investments to address these issues, helping ensure our fellow Americans have safe, livable housing.

At the same time, homeownership is how people typically build wealth, achieve financial security and help their children purchase a home. For much of the 20th century, the federal government supported racial discrimination that limited this wealth-building process to White families. As a result, today, Black, Latino and other families of color frequently lack the intergenerational wealth to purchase a house—even if they can afford monthly mortgage payments. The cost of a down payment constitutes a primary barrier to homeownership.

The Build Back Better Act offers down payment assistance for first-generation homebuyers. This group is defined as first-time homebuyers whose parents have not been homeowners. As a high proportion of these families are Black, Latino, Native American, Asian American and Pacific Islander, this policy would be a powerful tool to narrow the racial homeownership and wealth gaps. Skimping on this funding would be a swing and miss for a Congress looking to advance racial and economic justice.

A recent poll found almost everyone agrees that “every child and family should have access to a safe, decent and affordable home.” Our country’s elected representatives have a once-in-a-generation opportunity to provide funding that propels us toward this shared goal. They should.

*****