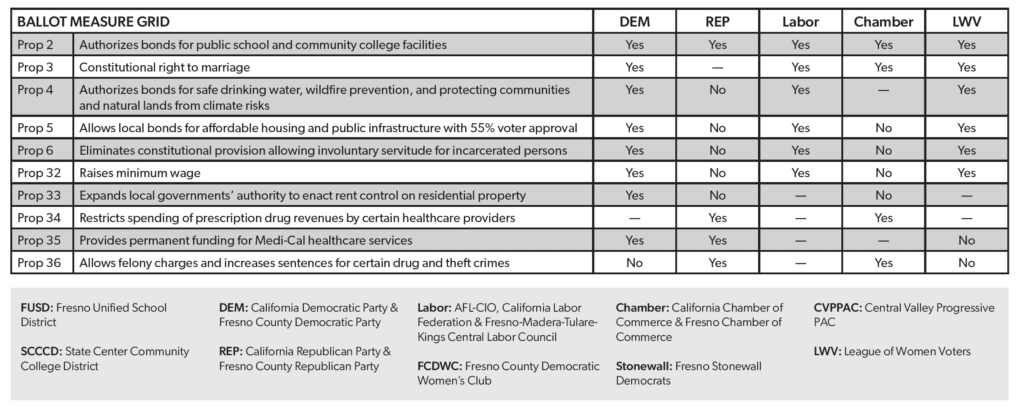

As noted in last month’s issue, your Nov. 5 ballot will include 10 statewide measures ranging from repairs for public school buildings to increasing the minimum wage. Other issues, including rent control, climate action, prisoner labor measures and a proposal for harsher penalties for theft and drug crimes will also be presented to voters for important, consequential decisions.

Last month, we presented Propositions 2–6. As promised, below is the second set of five of November’s 10 ballot measures, Propositions 32–36.

These measures will determine how Californians will live their daily lives, so every vote counts. Remember: Not voting is still a vote—for the other side.

Proposition 32: Raises Minimum Wage

Nutshell: A “yes” vote supports increasing the minimum hourly wage to $18 by 2026 for all employees. The hourly rate would be adjusted annually to account for increases in the cost of living, starting in 2027. This initiative will increase the hourly wage over several years, at a faster rate for businesses with 26 or more employees, and at a slightly slower rate for those with 25 or fewer employees. The current hourly minimum is $16; a “no” vote will keep it that way.

Background: The Yes on the California Living Wage Act effort is being led by the Working Hero Action for the Living Wage Act Committee, a PAC that has been at the helm of this initiative and has raised more than $10 million. The initiative follows recent successful union efforts to secure a $25 per hour wage for healthcare workers and a $20 per hour wage for fast-food employees.

Some individual municipalities have already raised their hourly wage—West Hollywood’s is $19.08, for example. From 1996 to 2022, there were 28 ballot measures for minimum-wage increases presented to U.S. voters, who approved 26 of them. In 2016, passage of California’s Senate Bill 3 increased the state minimum wage incrementally until it reached $15 in 2022, to be adjusted annually for inflation (hence it is now at $16 per hour).

Businesses with fewer than 25 employees did not have to meet the $15 per hour minimum wage until 2023. Though the federal minimum hourly wage is $7.25, state law supersedes when a state’s rate is higher. Is the current $16 per hour enough? That adds up to an annual income of a little more than $30,000, while the average cost of living is above $53,000. An $18 per hour wage would push annual incomes closer to $35,000 but might still fall short of meeting the cost of living.

Who supports it: Working Hero Action for the Living Wage Act PAC, Kevin de Léon Believing in a Better California Ballot Measure Committee—Yes on Propositions 3, 32 and 33

Who opposes it: California Chamber of Commerce, California Restaurant Association, National Federation of Independent Businesses

Proposition 33: Justice for Renters Act: Rent Control

Nutshell: A “yes” vote would allow counties and municipalities the power to control rent on any residential housing, including for first-time tenants. It would support the repeal of the 1995 Costa-Hawkins Rental Housing Act, which has prohibited rent control statewide.

Background: The text of the Justice for Renters Act is short: “The state may not limit the right of any city or county to maintain, enact or expand residential rent control.” The 1995 Costa-Hawkins Act generally has permitted landlords to set initial rental rates, and though it was enacted with the goal of balancing landlord-tenant interests, California’s residential housing picture has changed dramatically since 1995, and the advantage has tipped unfairly to landlords.

Since the enactment of this law, limits have been imposed on how much cities can limit rising rents. Under Costa-Hawkins, no rent control has been permitted on single-family houses or apartments built after 1995, and landlords have had no limits on setting their own rental rates whenever new tenants occupy a residence.

Our state’s rents are among the highest in the nation. Consequently, the housing shortage is severe, as is the homelessness crisis. Tenants’ rights advocates have found that the Costa-Hawkins Act has exacerbated problems of access to housing because of the permission it grants to landlords in raising rents without limits.

Previous ballot measures designed to overturn Costa-Hawkins in 2018 and 2020 were not successful, but Governor Newsom in 2019 signed legislation limiting annual rent increases to 5% plus an allowance for inflation. Still, more than 30% of Californians currently pay more than half of their incomes on rent.

Real estate industry affiliates, including corporate landlords, have mobilized in opposition to this rent-control measure, raising more than $60 million (the California Association of Realtors alone contributed $20 million—where’d they get all that money?) compared to rent-control proponents’ $20 million total.

Who supports it: AIDS Healthcare Foundation, California Democratic Party, Veterans’ Voices, California Nurses Association, California Alliance for Retired Americans, Housing Is a Human Right, Affordable Housing Alliance, Consumer Watchdog, Rep. Maxine Waters (D–Los Angeles), Rep. Barbara Lee (D–Oakland), Dolores Huerta Foundation

Who opposes it: California Association of Realtors, California Small Business Association, California Apartment Association, California Chamber of Commerce, and mega-landlords Equity Residential and The Irvine Co.

Proposition 34: Limit Major Healthcare Group’s Non-Patient Spending

Nutshell: Ostensibly, Prop 34 purports to limit the amount of revenue that specific healthcare providers would be permitted to spend on anything other than non-patient care. The language of the initiative is obfuscating and confusing, probably because its sponsors and supporters are disingenuous about its purpose.

The measure does in fact appear to be a “revenge” effort led by the real estate industry—its chief sponsor is the California Apartment Association—to curtail housing-advocacy spending by the AIDS Healthcare Foundation, which is the principal sponsor of Prop 33, the “Justice for Renters” rent-control act.

Background: The nuts and bolts of the measure sound like mumbo-jumbo: Ballotpedia summarizes the ballot measure text as follows: “Proposition 34 would establish a new category of entities called ‘prescription drug price manipulators.’ If an entity is classified as a ‘prescription drug price manipulator,’ the entity would have to meet the following requirements annually to maintain its tax-exempt status and licensure as health insurance plans, pharmacies and clinics: spend at least 98% of revenues from the federal discount prescription drug program on direct patient care and not engage in unprofessional conduct or conduct contrary to public health, welfare or safety.”

However, the California Legislative Analyst’s Office has noted that, to qualify as a “prescription drug price manipulator,” there are extremely few entities that would meet the measure’s criteria, which further casts suspicion on the motivations of the measure’s sponsors.

Who supports it: California Republican Party, California Apartment Association

Who opposes it: AIDS Healthcare Foundation, Consumer Watchdog, National Organization for Women

Proposition 35: Protect Access to Healthcare Act: Taxing Managed Care Organizations

Nutshell: Prop 35 imposes a permanent tax on health insurance providers, such as Kaiser or Anthem—managed-care organizations (MCOs) that offer services for a monthly fee. In addition to taxation, the measure would account for how the money collected could be spent.

Background: The state legislature recently expanded the range of people who can be covered under Medi-Cal; those who meet the income criteria, without regard to their immigration status, are now eligible. To pay for this expanded Medi-Cal coverage, Prop 35 is designed to increase funding via tax to cover the care it will provide.

MCO taxes are not new. But last year, Governor Newsom and the state legislature made the decision to renew the tax to help fund the expanded coverage. Some of that revenue will go for Medi-Cal reimbursements to healthcare providers, which advocated for increased reimbursement rates to help ensure that treatment shortages or long patient wait-times will be avoided.

Who supports it: California Democratic Party, California Republican Party, SEIU California State Council, California Dental Association, California Hospital Association, California Medical Association, California Primary Care Association, Planned Parenthood Affiliates of California

Who opposes it: No registered opposition

Proposition 36: Homelessness, Drug Addiction and Theft Reduction Act: Harsher Penalties for Theft and Drug Crimes

Nutshell: This measure reflects the movement to reform some aspects of Prop 47, which reduced some crimes from felonies to misdemeanors.

Background: Prop 47, passed in 2014, was intended to “ensure that prison spending is focused on violent and serious offenses, to maximize alternatives for non-serious, nonviolent crime, and to invest savings in prevention and support programs in K-12 schools, victim services, and mental health and drug treatment” as well as to ensure “that sentences for people convicted of dangerous crimes like rape, murder and child molestation are not changed.”

Except for those with prior convictions, Prop 47 shifted some crimes, including some thefts and drug crimes, from felonies to misdemeanors. A contingency of opponents of Prop 47 have collected sufficient signatures for a petition to support putting Prop 36, which they see as a corrective measure, on the November 2024 ballot.

A similar initiative was rejected by voters in 2020; it sought to lengthen criminal sentences and reduce the number of parolees.

Why is “homelessness” in the name of this act? Although proponents of Prop 36 appear to generally, perhaps unfairly, connect homelessness with crime and drug use, opponents of Prop 36—and supporters of Prop 47—say that Prop 47–funded behavioral-health programs have reduced both homelessness and recidivism.

The Legislative Analyst’s Office estimates that such funding if lost would figure in the low tens of millions should Prop 47 go away. As passage of Prop 36 would increase incarceration, it could consequently increase homelessness, as formerly incarcerated individuals are about 10 times as likely to experience homelessness as others. How serious a problem is shoplifting now?

Despite a recent uptick, shoplifting crimes remain below pandemic-era levels, and crime in general in California is well below historic peaks. Nevertheless, the perception that crime is on the rise seems to have taken hold. About $10 million has been raised in support of Prop 36, whereas under $1 million has been raised by opponents.

Who supports it: Walmart, Target, Home Depot, California State Sheriffs’ Association, San José Mayor Matt Mahan, San Francisco Mayor London Breed, California Republican Party, California District Attorneys Association

Who opposes it: California Attorneys for Criminal Justice, ACLU of Northern California, Action for Safety and Justice, Anti-Recidivism Coalition, Disability Rights California, Committee to Protect Public Safety, No on Prop 36